WHAT THE HAIL IS GOING ON IN TEXAS?

Our litigation system is supposed to be about resolving legitimate disputes that cannot otherwise be resolved. Civil justice is corrupted when lawsuits are manufactured for the purpose of enriching a handful of lawyers and those who ensnare clients on their behalf. Today, there are plaintiff trial lawyers who are using hailstorms as fonts of personal wealth.

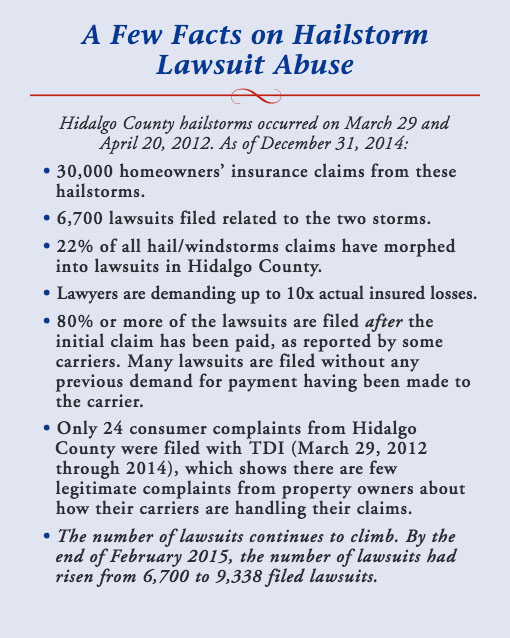

Hail is a pervasive part of Texas weather and therefore can provide an endless stream of riches for plaintiff lawyers who are manipulating the Texas insurance code at the expense of Texas homeowners and commercial property owners. The explosion of hail litigation against insurance carriers will result in decreased competition among carriers, higher deductibles, and higher premiums. If corrective actions are not taken to curb the litigation abuse, it is likely that many Texans who own modest-priced houses will not even be able to buy homeowners insurance in parts of our state. If an insurance carrier pays a property claim in good faith but is “a day late or dollar short” in making the payment, the insurance code allows extraordinary remedies against the carrier: damages plus an 18% penalty interest plus pre-judgment interest plus attorney fees. This statute is intended to incentivize carriers to pay claims timely and fully. But in the hands of a few mass tort lawyers who utilize a solicitation apparatus to harvest hundreds or thousands of clients to file lawsuits (most or all of which have no merit), the statute is distorted to establish an extortion racket. Those who pay for this racket are consumers who see their deductibles and premiums rise or who are unable to purchase insurance at all. To illustrate the lawsuit abuse, here is what happened in Hidalgo County after a hail event. Unscrupulous public adjusters and roofers solicited clients for a handful of plaintiff lawyers by knocking on doors and setting up booths in public places. Lawyers advertised in numerous ways, including billboards. Property owners were told that they could sue their insurance carriers even if the carriers had already paid the hail claims of the property owners. One small Texas insurance carrier who insured homes in Hidalgo County had 2,517 claims and a stupendous 688 lawsuits related to those claims (27.33% of the claims). To give you an idea of the extraordinary nature of this number of lawsuits, this same carrier after Hurricane Ike a few years ago had 11,759 claims and only 66 lawsuits related to those claims (0.56% of the claims). In this edition of The Advocate, you will learn more about this lawsuit abuse and current attempts in the Texas Legislature to correct the abuse.

STORM CHASERS: THE LATEST WAVE OF AMBULANCE CHASERS

Storm-chasing attorneys, the latest wave of ambulance-chasing plaintiff lawyers, are busy filing massive numbers of hail-damage lawsuits that are reducing consumer access to property insurance and will increase property insurance premiums and raise deductibles for hail damage – all of which will work a hardship on property owners and negatively impact the Texas economy. This latest plague of lawsuits started in Hidalgo County, but a growing body of statistical and anecdotal evidence shows the litigation abuse is spreading across Texas.

A CRISIS FOR TEXAS HOMEOWNERS

Texas has the most severe weather in the nation. Hailstorms cost the Texas marketplace $10.3 billion in damages from 2004 through 2013. Now hail damage is becoming even more expensive – not because of the damage it causes, but because of the explosion in lawsuits generated by storm-chasing trial lawyers. Lawsuits against insurance companies arising from hail damage in Texas have skyrocketed. The number of lawsuits filed in recent years is far higher than historical norms and far out of proportion with other states. The following chart shows how litigation has exploded against one small Texas insurance carrier in recent years:

At least two insurance carriers have decided they must quit writing homeowners’ insurance in Hidalgo County and other carriers are contemplating doing so. This will diminish consumer access to affordable property insurance. Some property owners have already reported an increase in deductibles to such a high level that hail claims are essentially going uncovered.

STORM-CHASING LAWYERS ARE PERVERTING THE INSURANCE CODE

The trial lawyers who file these lawsuits on behalf of policyholders against insurance companies allege that the insurance companies did not timely or fully pay claims for hail and wind damage. But up until recently, very few policyholders pursued litigation or filed complaints against their insurance companies following a hailstorm. The number of consumer complaints has remained largely unchanged over the past few years. In 2014, the Texas Department of Insurance (TDI) reported that the number of justified complaints filed with TDI totaled only 304 out of an estimated 340,000 homeowner claims, less than one tenth of one percent. Homeowner complaints filed with TDI, in fact, have declined each year for the past five years, through 2014. Nevertheless, the number of lawsuits against insurance companies by policyholders has skyrocketed during that period. Some insurers in the Rio Grande Valley have reported that about one-third of claims in the last two years are involved in litigation. Hailstorms have not changed. Insurance policies have not changed. Insurance laws have not changed. The only explanation for the spike in litigation is the influence of attorneys seeking to generate lawsuits for the purpose of earning legal fees.

CASHING IN ON THE MISFORTUNES OF OTHERS

Plaintiff attorneys and their solicitors are pursuing these policyholder claims because an attorney fee award and an 18% penalty are mandatory under Texas law if an insurance company is just a day late or a dollar short in paying a claim. Even a small claim carries automatic attorney fees that are many times greater than the amount of the claim itself. Therefore, insurance companies feel compelled to settle claims for many times their value to avoid even more costly litigation. This enriches the lawyers, while ultimately hurting all of our state’s policyholders. Trial lawyers aren’t the only ones cashing in on the misfortune of others. Disreputable public adjusters are descending in droves on areas hit by hailstorms. These public adjusters set up shop in parking lots or other public places following a hail storm, recruiting clients by promising homeowners big dollars from their insurance company – even if their hail claims have already been paid. The unscrupulous public adjusters take the clients they recruit to trial lawyers and get paid a fee for doing nothing more than securing a client for the lawyer.

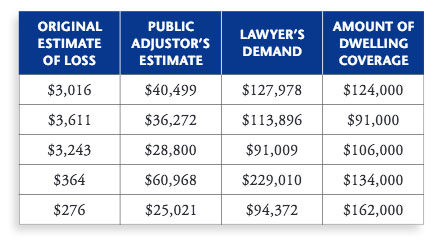

Here are just five examples from one insurance company, comparing company loss estimates for hail damage and then showing what happens to a loss as it passes through the hands of a soliciting public adjuster and the demand from the lawyer.

STORM-CHASING LAWYERS ARE FOLLOWING STEVE MOSTYN’S LEAD

Houston mass tort lawyer Steve Mostyn paved the way in this new abusive litigation against property and casualty insurers. Mostyn made a fortune after Hurricane Ike by recruiting thousands of clients through advertising and manipulating the statutes regulating the Texas Windstorm Insurance Association. Fortunately, the Legislature enacted reforms to prevent future lawsuit abuses related to hurricanes, so now Mostyn is filing hail-related lawsuits throughout Texas. Other law firms are copying Mostyn and employing a similar storm-chasing strategy following hail events. In addition to advertising for clients, these lawyers have joined with roofers, public adjusters, contractors, and others – some with questionable or no qualifications – to help them find clients, often through door-to-door solicitation. These unscrupulous third parties push homeowners to make claims even after their initial claims have been paid and to hire lawyers to pursue lawsuits that demand payments of many times the amount of their initial claims. If allowed to continue, these unethical and malicious practices by plaintiffs’ lawyers and greedy third parties will hurt homeowners by increasing claims costs, raising deductibles and insurance rates, restricting coverage across the marketplace, and clogging court dockets.

ADDRESSING THE LAWSUIT EXPLOSION: HB 3646 BY JOHN SMITHEE AND SB 1628 BY LARRY TAYLOR

Rep. John Smithee (R-Amarillo) and Senator Larry Taylor (R-Friendswood) have filed companion bills in the Texas House and Senate aimed at stopping the abusive practices of the trial lawyers and public adjusters. These bills require notice to a carrier before a suit is filed, make unlawful the practice of inflating roofing estimates to cover the deductible, and prevent the payment of referral fees to people who collect clients for trial lawyers. In addition – and in a sign that legislators are recognizing the scope and severity of this problem – many other legislators have filed bills aimed at addressing specific components of this latest trial lawyer scheme to get rich. Many of these bills are aimed at the abusive tactics of public adjusters and roofers. Others seek to clarify the operation of the statute of limitations as applied to property insurance claims or to cap fees that may be paid to attorneys. The various bills are listed on Page 4.

Proposed Legislation Filed to Address the Storm Chasing Lawsuit Crisis

Proposed Legislation Filed to Address the Storm Chasing Lawsuit Crisis, in addition to HB 3646 and SB 1628.

HB 1488 (Rep. Kenneth Sheets, R-Dallas)—creates a voluntary registration mechanism for roofers.

HB 2893 (Rep. John Frullo, R-Lubbock)/ SB 876 (Sen. Kevin Eltife, R-Tyler)—requires insurance adjusters to participate in continuing education.

HB 2971 (Rep. Giovanni Capriglione, R-Southlake)— amends insurance fraud statute regarding inflating claims to cover deductibles.

HB 3148 (Rep. Eddie Rodriguez, D-Austin)—requires construction contractors to register with the Texas Commission of Licensing and Regulation.

HB 3353 (Rep. Armando Walle, D-Houston)—provides that a public adjuster may not solicit business and adds public adjusters to the criminal barratry statute.

HB 3636 (Rep. Ryan Guillen, D-Rio Grande City)—makes a statute prohibiting roofing contractors from acting as adjusters applicable to all contractors.

HB 3697 (Rep. Brooks Landgraf, R-Odessa)—limits attorney fees that may be recovered by a policyholder in litigation against an insurance company for payment of a property damage claim.

HB 3754 (Rep. Doug Miller, R-New Braunfels)—requires the Texas Department of Insurance to produce a consumer guide about selecting a roofing contractor.

HB 3787 (Rep. Greg Bonnen, R-Friendswood)—allows insurance policies to specify a limitations period for filing a claim or filing a lawsuit. HB 3834 (Rep. Ed Thompson, R-Pearland)—adds public adjusters to the criminal barratry statute.

HB 3851 (Rep. Ed Thompson, R-Pearland)—amends the insurance fraud statute to clarify prohibition of rebates of insurance deductibles.

HB 3910 (Rep. Dennis Paul, R-Webster)—requires insurance adjusters to participate in continuing education.

HB 3940 (Rep. Morgan Meyer, R-Dallas)—extends insurance claim-handling deadlines after the governor or insurance commissioner declares an emergency or catastrophe.

SB 1060 (Sen. Juan “Chuy” Hinojosa, D-McAllen)— prohibits a public adjuster from soliciting clients for, or receiving a fee from, an attorney.

SB 1166 (Sen. Van Taylor, R-Plano)—requires an insurance policyholder to provide an affidavit specifying the amount of damages and provides for attorney fee shifting for an excessive demand