April 12, 2017

Re: HB 1774 by Bonnen of Friendswood

Storm chasing by lawyers is the worst lawsuit abuse Texans have confronted since asbestos litigation, which finally ended when the Legislature enacted SB 15 in 2005. The storm-chasing lawyers have filed at least 36,000 cases since 2012, naming at least one innocent individual as a co-defendant in over 14,000 of those cases.

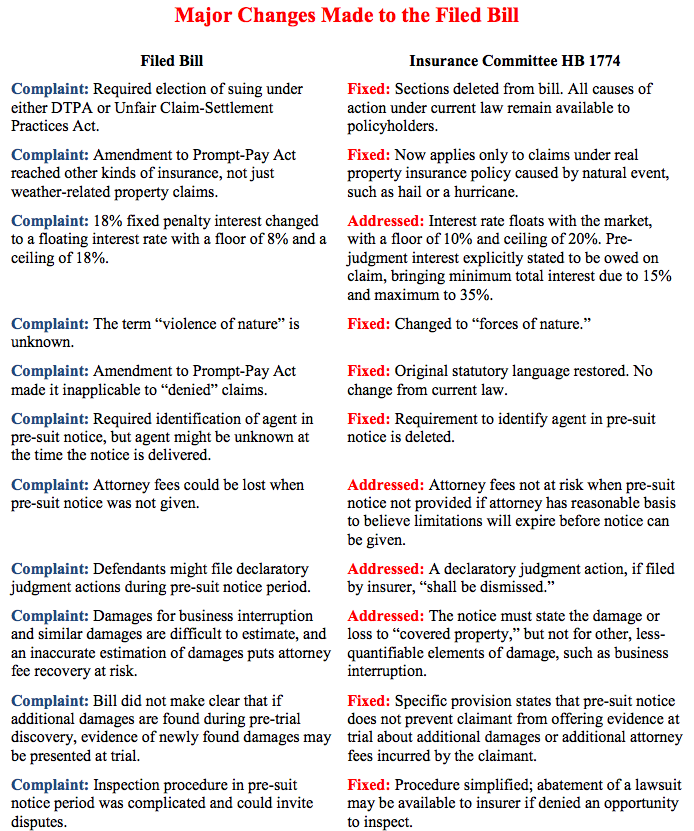

Dr. Greg Bonnen and House Insurance Committee Chairman Larry Phillips repeatedly met with stakeholders (including trial lawyers who oppose the legislation), listened to their concerns, and made meaningful changes. The resulting committee substitute is tailored to stop the abusive litigation practices, while preserving Texas as the most policyholder-friendly state in the nation. The House Insurance Committee voted out HB 1774 on April 4 in a 6 – 3 vote.

Dr. Bonnen is joined in authoring HB 1774 by four joint authors: Chairmen Larry Phillips, Eddie Lucio III, John Frullo and Tan Parker. As of today, a total of 83 members have signed the bill, including 21 chairmen, 19 vice-chairmen, 17 lawyers, the chair of the House Republican Caucus, and the speaker pro tem. Sen. Kelly Hancock’s Senate companion, SB 10, has 20 signatories.

Texas leads the nation in exports (including technology exports), has been ranked for a decade as the No. 1 state in which to do business by our nation’s CEOs, and has been awarded the Governor’s Cup for five years in a row for being the top performing state for capital investment and job creation. There are more Texas companies listed on the New York Stock Exchange than any other state. Our $1.5 trillion economy is the tenth largest in the world. Russia is No. 11.

In significant part, this success is due to tort reform. But we must be ever diligent against plaintiff lawyers who exploit and degrade our legal system, as do the storm-chasing lawyers. Together, we must stop lawsuit abuse whenever it occurs, no matter which industry is targeted, just like we have done for over two decades. In a word, passage of HB 1774 is critical.

We appreciate your service to our state.

The Problem

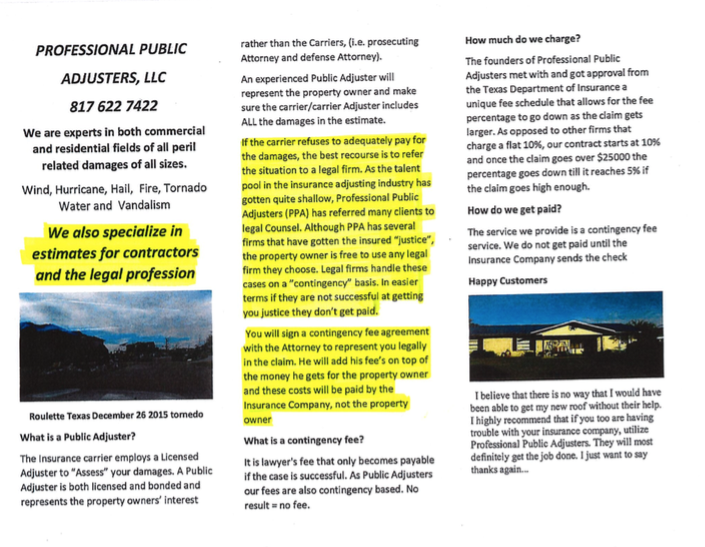

No one disputes that severe weather causes damage, but storm-chasing lawyers have created a new mass-tort model to profit from weather events. Rather than encouraging a quick resolution of legitimate disputes, storm-chasing lawyers are soliciting clients, manufacturing and exaggerating damages, failing to give notice to insurers before filing lawsuits, and routinely suing innocent individuals for manipulative litigation purposes. This is blatant lawsuit abuse.

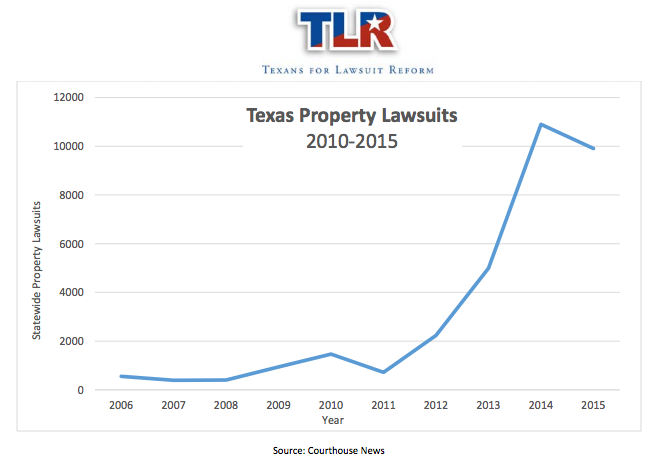

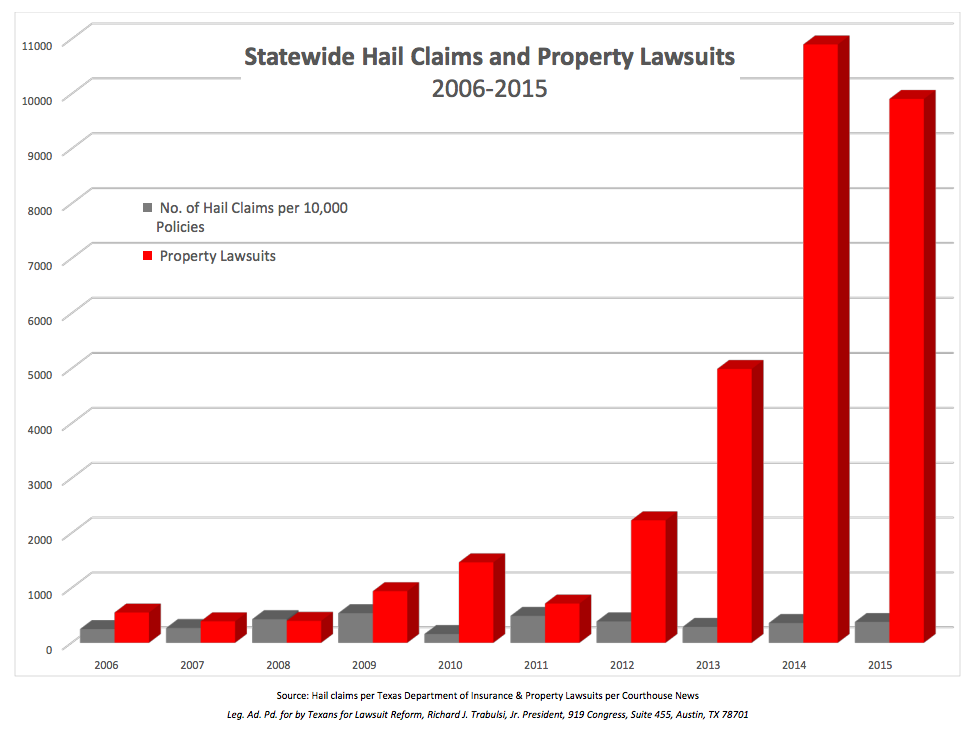

According to the Texas Department of Insurance, weather-related lawsuits against property insurers have increased 1,400% since 2012. At least 12 property insurers have raised their rates, and seven insurers have reduced, limited or stopped writing coverage as a result of the increased litigation.

This lawsuit abuse has serious consequences for every property insurance consumer in our state. Texans are no strangers to severe weather – that’s why we pay some of the highest property insurance rates in the nation. Unnecessary and abusive litigation creates a hidden tax on consumers that will continue to lead to increased premiums or deductibles, or reduced or lost coverage.

Evidence of Lawsuit Abuse

1. The Explosion in Lawsuits

• More than 36,000 lawsuits have been filed statewide since mid-2012.

• Prior to this, there was an average of 744 lawsuits filed per year from 2006-2011.

• There were 28 times more lawsuits filed in 2014 than in 2007.

• 14,000 of these lawsuits have included an individual as a defendant, using hardworking Texans as mere litigation pawns.

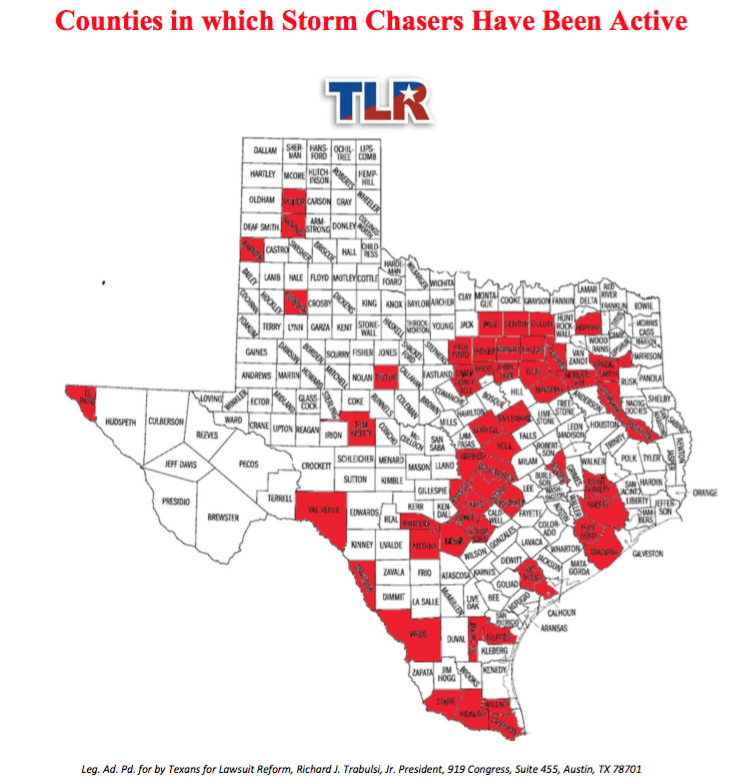

2. There is a Statewide Effect

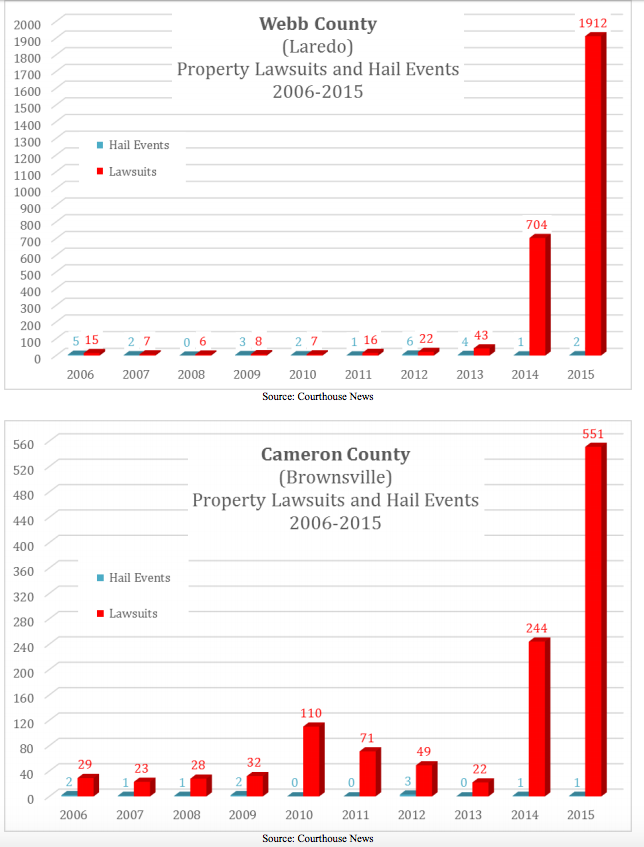

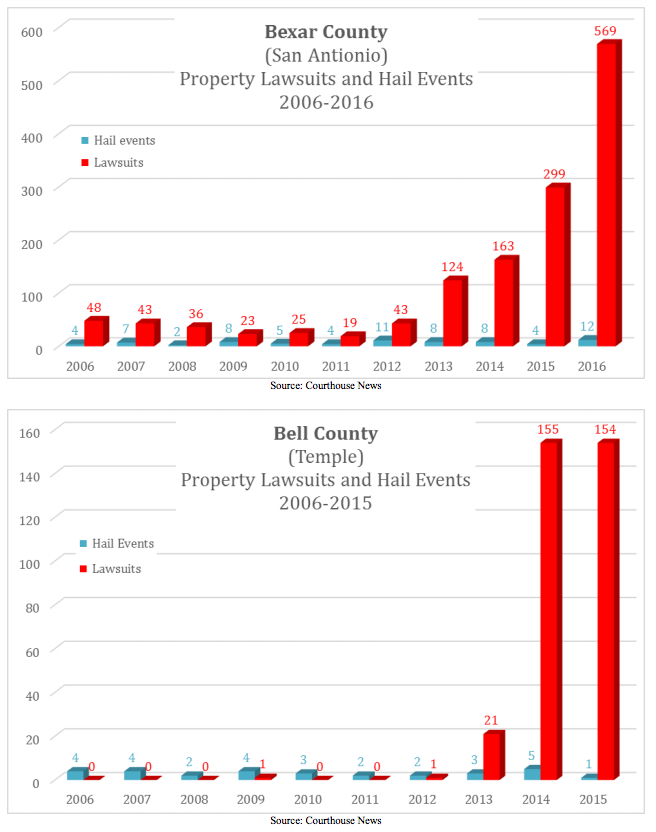

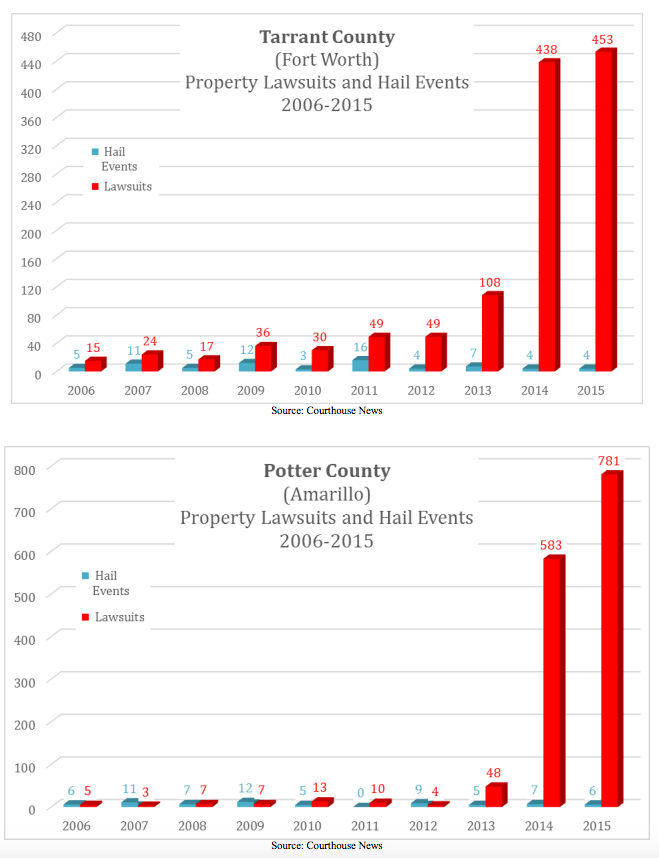

• 55 counties have seen increased litigation, including every major metropolitan area.

• Problem stretches from Brownsville to Amarillo, and from El Paso to East Texas.

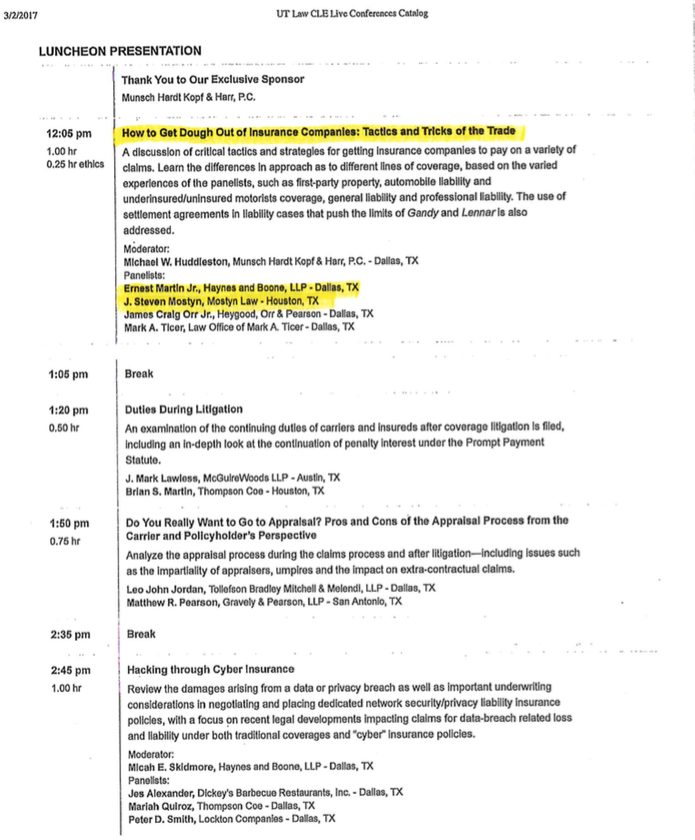

3. Carpetbagging Lawyers are Filing Lawsuits

• These are not organic lawsuits – property owners are being solicited by out-of-town attorneys and case runners.

• The top 10 most active storm-chasing law firms are responsible for more than half of the lawsuits filed.

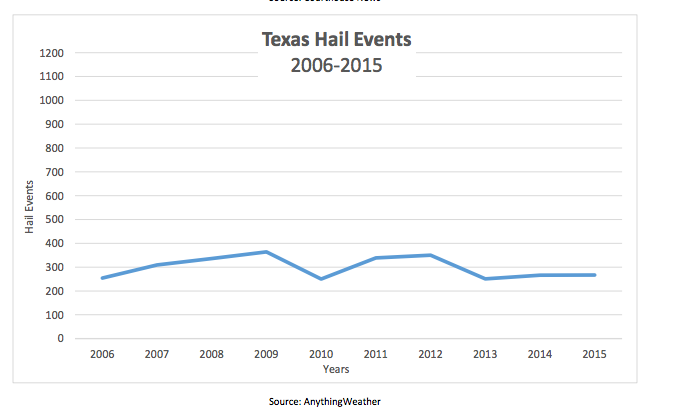

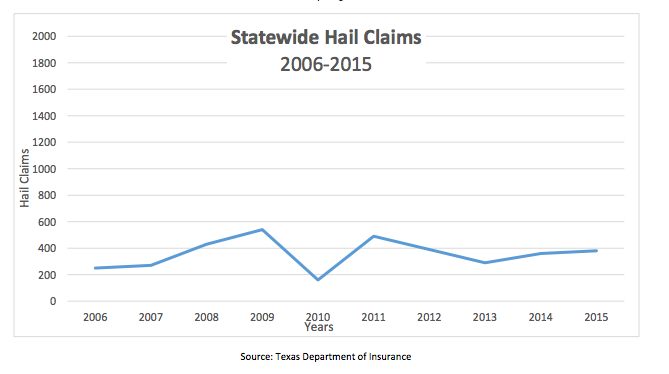

4. There is No Explanation other than Lawyer Activity

• There has not been a significant increase in the number or severity of hail storms in Texas.

• Texas population has not grown at the same rate as lawsuit filings.

• The only thing that has changed is aggressive lawyer solicitation and recruiting of clients, and the adoption of mass-tort tactics to extort settlements.

Judges Criticize the Tactics of the Storm Chasers

Judges Criticize the Tactics of the Storm Chasers

Judge Micaela Alvarez

“In a bout of cosmic irony, the Mostyn Law Firm has unleashed a hailstorm of its own upon the Court in the form of baseless claims. The Court is not pleased.”

“The Court has observed an unacceptable and systematic practice by Plaintiff’s counsel – the Mostyn Law Firm – of filing numerous and unfounded claims.”

“[T]he Mostyn Law Firm finds it worth everyone’s time and energy to lop upon their breach claim numerous extra-contractual theories without any apparent justification.”

“[T]he Mostyn Law Firm consistently fails to allege any facts supporting extra-contractual injuries. Instead, they are content to squander valuable time fruitlessly answering decisive motions for summary judgment against them.”

“[T]he Mostyn Law Firm’s practice of systematically pleading and defending extra-contractual claims based solely on payment disputes is both wasteful and futile.”

“[B]eyond merely copying-and-pasting these claims from their templates and dropping them into case filings, the Mostyn Law Firm did not bother to specifically bring up, argue, or support these claims in any fashion.”

“It comes as no surprise that the Mostyn Law Firm’s extra-contractual claims arise not only unjustifiably, but also uniformly—they are undoubtedly part of a template the Mostyn Law Firm uses in hailstorm petitions.”

“It troubles the Court to see instances in which the insured and insurer appeared to resolve all disputes under the contract, and then years later suit is filed for no apparent reason—putting aside the attorney knocking on the insured’s door.”

***

Judge Alia Moses

“Each of these allegations, if true, is sanctionable conduct. For example, the Voss Law firm’s failure to discuss the indemnity payment with the Hernandezes violates the Texas Rules of Professional Conduct and unduly prolongs the litigation process by preventing possible settlement and negotiation. Similarly, the Voss Law Firm’s failure to mention either settlement offer to their clients is also a violation. Furthermore, serving up fraudulently verified interrogatories rises to the level of bad faith among other violations. Taken together, it looks to the Court like the Voss Law Firm was keeping its clients in the dark for its own benefit.

Read the full order here: Alaverez Order

Read the full order here: Hernandez Gregorgio v. SFL

Texas Farm Mutual Insurance Companies and Independent Agents Speak Out

David Weber – Hochheim Prairie Insurance

“Between 2003 and 2011, Hochheim only received 40 hail-related lawsuits in the entire state of Texas. Until recently, Hidalgo County was the largest county in Texas served by Hochheim with over 7,600 policies and total insured value of almost $1.3 billion. Hidalgo County experienced two large hail events in 2012 with initial losses for Hochheim totaling about $26.5 million. However, after the explosion of mass litigation, the ultimate loss for these events more than doubled to $56.1 million, resulting in a loss ratio of 1,117%. Hochheim received 914 litigated matters from 2012 events in Hidalgo County, but litigation continued in Hidalgo County after 2012 with an additional 198 litigated matters received from 2013-2015 claims.”

“Hochheim’s finances were adversely affected by the growth in litigation, resulting in many tough decisions by management that directly impacted our members. Hochheim terminated its five agents in Hidalgo County, which resulted in the cancellation of these policies. Many of these members reported difficulty in finding replacement insurance coverage and experienced premium increases of 2-3 times their previous payments.”

“Hochheim also had to reduce its exposure and limit growth across the entire state of Texas as its resources were being diverted to address the costs and reserves related to litigated matters. Hochheim’s second largest county, Fort Bend, which had 3,300 policies and total insured value of almost $900 million, were canceled as Hochheim stopped writing in that county to limit its exposure to another large event… Premiums have increased for our members to account for losses related to litigation and claims development. Mass litigation has directly impacted the availability and affordability of insurance in many parts of the state.”

Paul Ehlert – Germania Insurance

“As an example, Hurricane Ike in 2008 produced 11,759 property claims for Germania. 66 of those claims resulted in lawsuits, a 0.56% litigation to claims ratio. Four years later in 2012, two hailstorms in Hidalgo County produced 2,715 claims. 870 of those claims resulted in lawsuits, a 32% litigation to claims ratio. Due to the inability to actuarially price our property insurance coverage where 32% of claims result in litigation, Germania Farm Mutual was forced to discontinue writing property insurance in Hidalgo County.”

“Being a mutual insurance company writing only in the state of Texas, our Texas policyholders are the ones suffering through withdrawn coverages and increased rates.”

Wiey Shockley – RVOS Farm Mutual Insurance Company

“With RVOS Farm Mutual it has been necessary to implement rate increases to cover inflated legal demands based on grossly exaggerated estimates. In addition, we are no longer accepting new business in some counties because an actuarially sound rate cannot be determined due to excessive litigation.”

“Our experience has shown that this abuse of our legal system is not limited to any one area and occurs to some degree anywhere that hail occurs…”

John Stephens – Farm Bureau Insurance

“In March of 2012, there was a large hail storm in Hidalgo County. By then, we were asking adjusters to track when a public adjuster (“PA”) or attorney was involved in a claim. We experienced an unprecedented increase in the number of claims involving an attorney or PA after this storm. Subsequent storms in 2013, 2014 and 2015 in neighboring South Texas counties have created the same issues, and the data is fairly dramatic.

If you look across the years 2012 to 2015, the percentage of disputed wind and hail claims across the entire state was typically about 1%. However, over the same time frame, the percentage of claims involving an attorney or PA in these South Texas counties was 29%, thirty times higher than anywhere else in the state. In Hidalgo County alone, the rate was 40%. This increase happened despite the fact that we had the same adjusters on staff as we had the year before with the same adjusting procedures.”

“Despite the fact that our experiences were the most difficult in South Texas, we see similar attorney activity in any areas of the state where a large volume of claims occur. In recent years, this is usually a large hail event but similar activity occurs after a wildfire and without a doubt will happen after a hurricane. All Texans witnessed the litigation explosion after Hurricane Ike that almost broke the Texas Windstorm Insurance Association. The problem was so severe the Legislature took swift action in the next session to change the law and protect TWIA from further litigation abuse.”

James Dickey – iMGA, Independent Insurance Agent

“Thanks to those lawsuits, in the second half of 2015, the insurance company that had been backing us refused to do so anymore.

We desperately searched for another company. It took months, and as a result, we had to non-renew hundreds of customers from all across the state – not just those in the lawsuit- prone areas.”

“We were finally able to find another company willing to step up. But they could only do so if we significantly increased rates and deductibles, and stopped selling policies at all in the counties where we’d had the worst lawsuit experience.”

Buddy Steves, Myron F. Steves Co., CMGA

“The owners of lower valued dwellings… are disproportionately affected by the abusive litigation as this vulnerable constituency has fewer resources to absorb actuarially fair premium increases, coverage restrictions and higher deductible or co-insurance penalties. The litigation, pursued in the name of consumer protection, imposes a substantial regressive tax on the most vulnerable property owners (and renters) in our state for the primary benefit of a handful of mass tort attorneys…”

“In addition to this regressive tax, the storm of litigation makes it much less likely that the private insurers will invest in market-based solutions to depopulating TWIA, the Texas FAIR Plan or the National Flood Insurance Program.”

Abraham Padron – SafeGuard Insurance Agency

“In the Rio Grande Valley, independent insurance agents witnessed a withdrawal of carriers, from 2012-2014, who cited the rampant litigation related to the hailstorms of 2012 in Hidalgo County as the reason. This reduction in the availability of insurers resulted in significantly increased premiums for consumers and hurt the growth of our local economy by making it harder to close on home mortgages and commercial real estate transactions.”

“The effect has already permeated other parts of the state that are prone to hailstorms, so this is no longer a Rio Grande Valley issue.”

Defense Lawyers Describe this Lawsuit Abuse

C. David Kinder – Dykema Cox Smith – San Antonio

Since 2012, tens of thousands of wind/hail lawsuits have been filed throughout Texas. Many times, these claims are meritless and are filed by the plaintiffs’ law firms with the sole intent for quick settlement. Insurance companies are forced to settle these meritless claims to avoid costly litigation. House Bill 1774 will help end this costly and unfair practice.

Dan MacLemore – Fulbright Winniford – Waco

In the last several years, I have deposed plaintiffs who did not know a lawsuit had been filed on their behalf until days before their deposition despite the fact the lawsuit had been pending for more than a year. I also deposed plaintiffs who never met or talked to their lawyer until the day of their deposition. Many of these plaintiffs signed contracts with their lawyers that were presented to them by public adjusters. Frequently, these plaintiffs did not know what they were signing or what it meant.

The overwhelming majority of these lawsuits are brought by attorneys solely for the purpose of obtaining outrageous fees.

Delinda R. Johnson – Packard, Hood, Johnson & Bradley – Amarillo

I have practiced law for approximately 27 years… However, nothing about the genteel practice of law in the Panhandle prepared me for the onslaught I witnessed after the May 28, 2013, hailstorm that occurred in Amarillo, Texas. As a resident and an attorney, I have witnessed some shocking and disappointing behavior by public adjusters, outside roofing companies and counsel.

Insurers are presented with outrageous demands made with no support or documentation for claims which were long since closed without complaint. Many times, suit is filed without a demand letter at all or at the same time the demand letter is sent. Plaintiffs’ counsel then continue to refuse to provide an estimate or detailed description of their damages until forced to do so by a court well into litigation. Instead, we receive “cookie cutter” petitions and no detail until their expert designation deadline expires.

Deposing the plaintiffs can be of little help. Many times they are not sure why their claim is in litigation. They have either been frightened or enticed to litigate a claim rather than assisted in resolving it because certain counsel wish to generate legal fees… I find myself feeling sympathy for these policyholders who have been dragged along for a very bad ride with their best interests disregarded.

David R. Stephens – Lindow, Stephens, Treat – San Antonio

It has become too easy to file meritless lawsuits with threadbare (if any) pre-suit investigation. These lawsuits have come in by the thousands and are far too often cookie- cutter petitions accompanied by inflated estimates with false claims of covered damage far too often. There needs to be some common-sense reforms which address the abuses but still provide protections to the consumers.

J. Richard Harmon – Thompson Coe – Dallas

Fundamental inadequacies in statutes originally designed to ensure prompt and fair payment of claims have all but made certain a floodgate of unnecessary and abusive litigation. The prompt payment statute currently has inadequate safeguards to prevent unnecessary lawsuits primarily designed to generate attorney’s fees relating to even the most minor weather event in Texas.

Paul M. Boyd – Boyd & Boyd – Tyler

During the course of my career, I have seen numerous situations in which adjusters have been named as defendants in lawsuits without justification. Typically, the primary purpose of naming an adjuster as a defendant is to destroy diversity jurisdiction and therefore, prevent a case from being removed to federal court. In virtually every case I have handled involving this practice, the adjuster has done nothing more than perform their responsibilities as an employee of an insurance company. Nonetheless, it is common practice for adjusters to be named as defendants so as to manipulate venue without consideration of the impact the action may have upon the individual adjuster and his or her family.

M. Micah Kessler and Ryan H. Newman – Nistico, Crouch and Kessler – Houston

We applaud the Legislature’s efforts to keep legitimate remedies available to Texas consumers while implementing measures to discourage vexatious and unnecessary litigation.

We are not aware of a plaintiff ever recovering money against an individual adjuster defendant in a lawsuit in Texas. It is no secret to anyone involved in Texas insurance litigation that adjusters get sued to manipulate jurisdiction.

The new provision would encourage the early, efficient resolution of property damage lawsuits by effectively forcing the parties to engage in a substantive and productive information gathering process before they incur significant legal fees. We believe this would benefit both consumers and insurance companies alike, as it would lead to more prompt resolution of property insurance disputes.

Victor V. Vicinaiz – Roerig, Oliveira & Fisher – McAllen

I have personally handled thousands of hailstorm lawsuits and I have prepared for and tried many such lawsuits. I am writing to support SB 10 and HB 1774 which will address the abuses that I have seen in weather related litigation.

Prior to the March/April 2012 Hidalgo County hailstorms, our firm saw very little first party weather related litigation. In fact, the most recent hurricane which affected the Rio Grande Valley was Hurricane Dolly in 2008. Hurricane Dolly caused a great amount of property damage to the Cameron and Hidalgo County areas. That significant storm resulted in a very minimal amount of lawsuits. In sharp contrast, the 2012 hailstorms which struck only the McAllen area resulted in well over 7,000 lawsuits.

In the time period between 2008 and 2012, the insurance companies which I represent had no significant changes in their claims handling policies or in the adjusters which they trained to adjust claims.

The insurance companies handled the 2012 claims in the same prompt and fair manner as those claims which had been presented to them prior to 2012. Yet there was a drastic increase in the number of attorney represented claims and lawsuits. There is no reasonable explanation other than these lawsuits are driven by plaintiffs’ attorneys.

Faced with thousands of lawsuits, and the current status of the law applicable to weather related litigation, insurance companies are generally faced with two decisions: 1) settle or 2) litigate and incur substantial litigation expenses.

Most insurance companies choose to settle in order to avoid the exorbitant cost of defending and trying thousands of cases and to avoid the risk imposed by current law. Unfortunately, of the cases that do settle, the merits of the case are rarely considered by plaintiffs’ counsel and the sole objective of plaintiffs is to force insurance companies to settle in order to avoid substantial risk and litigation expenses.

These bills are necessary on two fronts: the bills preserve the rights of consumers to pursue legitimate claims against their insurers and also shield insurance companies from baseless claims and lawsuits. I urge you to support passage of these two bills which continue to include and maintain the statutory protections Texas has historically afforded its consumers.

The Solution

With the enactment of HB 1774, consumers will continue to have a full toolkit for pursuing lawsuits against insurance companies that shortchange, delay payment or otherwise do not fulfill their contracts.

The major components of current law that will not change are:

- Consumers will have at least seven separate causes of action,

- Insurance companies will be subject to strict liability if shown to have underpaid a policyholder’s claim by a single dollar – no bad faith or bad conduct by the insurance company need be shown,

- Penalty interest will be paid on top of pre-judgment interest, creating a combined rate on late-paid claims that should incentivize insurers to pay claims on time and in full, and

- insurance companies will be required to pay a policyholder’s attorney fees.

The essential changes to the current law will be:

- A pre-suit notice already is required by law, but it is routinely ignored by storm-chasing lawyers. HB 1774 requires pre-suit notice prior to filing a lawsuit. If the lawyer fails to abide by this requirement, his recovery of attorney fees may be limited.

- Lawyers often make demands far in excess of the amount actually owed by the insurer. To address this problem, if the attorney recovers less than 20% of the damages he demands in the pre-suit notice, the defendant owes no attorney fees; if the attorney recovers 80% or more of what he demanded for his client, he may recover 100% of his fees; if he gets anything between 20% and 80%, his fees are prorated accordingly. For example, if he recovers 50% of his demand, he is awarded 50% of the fees he proves up. The policyholder, in any case, recovers all the damages found to be due her under the insurance contract.

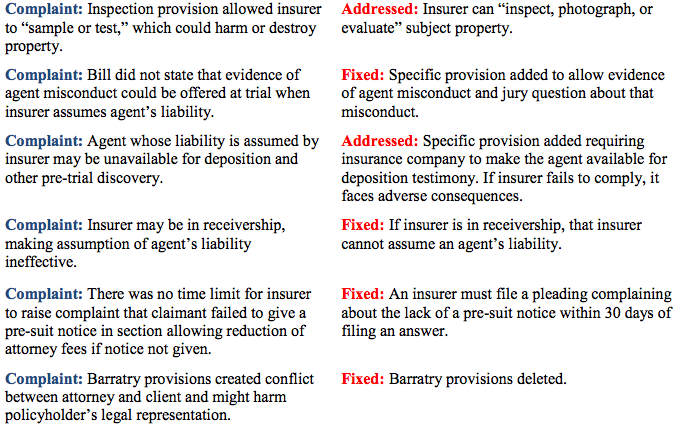

- HB 1774 stops the widespread practice of suing innocent individuals. It allows an insurer to assume the liability of an employee or agent, in which case that person will be dismissed from the case. But any evidence of wrongdoing by that person still can be presented in court, fault can be assigned to the individual, and the policyholder can recover from the insurance company for any damages caused by the individual. This keeps storm-chasing lawyers from using these individuals as litigation pawns while ensuring that the policyholder’s damages are paid in full.

HB 1774 makes the fewest statutory changes necessary to disrupt this mass tort model of abusive litigation that has caused an explosion in unnecessary lawsuits and is jeopardizing the affordability and availability of property insurance for us all.

Brief Outline of HB 1774

Section 1: Provides that a demand letter sent as required by Section 3 of HB 1774 triggers an insurance company’s existing right to make a settlement offer.

Section 2: Adjusts the penalty interest rate in the Prompt Payment of Claims Act to float based on the prime rate, with a floor of 10 percent and a ceiling of 20 percent. This change applies only to insurance claims from a nature-caused event that caused damage or loss covered by a policy insuring real property.

Section 3: Creates a new chapter in the Insurance Code—Chapter 542A—with four basic parts:

- Applicability: New Chapter 542A will apply to all insurance companies authorized to write property insurance in the state, except TWIA. It covers any first-party lawsuit related to an insurance policy covering damage to real property if the damage was “caused, wholly or partly, by forces of nature, including an earthquake or earth tremor, a wildfire, a flood, a tornado, lightning, a hurricane, hail, wind, a snowstorm, or a rainstorm.”

- Notice of Lawsuit: New Chapter 542A requires a pre-suit notice to an insurer at least 61 days before a lawsuit is filed, stating the facts giving rise to the complaint, the specific amount alleged to be owed for damage, and the amount of attorney fees incurred by the policyholder as of the date of the notice. The notice triggers the insurance company’s right to inspect, photograph and evaluate the property and make a settlement offer. If a pre-suit notice is not given or the insurer is denied the ability to inspect the property, the company may ask the trial court to abate the case. The failure to give pre-suit notice also may cause the attorney to lose his right to recover some attorney fees. The notice document is admissible in evidence at trial.

- Assumption of Agent Liability: New Chapter 542A provides that an insurance company may irrevocably assume the liability of any employee, agent, representative or adjuster who is sued by the policyholder. If the insurance company assumes this liability, the individual may not be sued. If sued, the lawsuit against the individual is dismissed. The insurance company must make the individual available to give deposition testimony, and the case is tried as if the individual was party to the case. The insurance company must pay any damages attributed to the individual.

- Award of Attorney Fees: In order to encourage realistic demands, new Chapter 542A provides that if the attorney wins for his client 80 percent or more of the amount the attorney demanded for the policyholder in the pre-suit notice, the attorney may have all of his fees paid by the insurer. If the attorney wins less than 20 percent of the amount demanded, he is not awarded any attorney fees. In between, the award of attorney fees is proportional based on the amount demanded and recovered.

Section 4: Provides that the changes apply to cases filed after the effective date.

Section 5: Provides that the Act is effective September 1, 2017, unless it receives two-thirds vote in both houses.

Applicability of HB 1774

HB 1774 will apply only to first-party lawsuits arising from an insurance policy covering damage to real property or improvements to real property if damage to the covered property was caused by a force of nature.

Background and Explanation

HB 1774 creates a new chapter in the Insurance Code—Chapter 542A. New Chapter 542A will apply to all insurance companies authorized or eligible to write property insurance in the state, except the Texas Windstorm Insurance Association. It covers any first-party lawsuit arising or related to an insurance policy covering damage to or loss of real property or improvements to real property, but only if the damage or loss of covered property was “caused, wholly or partly, by forces of nature, including an earthquake or earth tremor, a wildfire, a flood, a tornado, lightning, a hurricane, hail, wind, a snowstorm, or a rainstorm.”

A “first-party lawsuit” is one you bring against your own insurance company to which you pay premiums. In contrast, a “third party lawsuit” is against someone else’s insurance company, such as when you are involved in a car accident caused by another person, whose insurance company must pay your claim. New Chapter 542A does not apply to third-party lawsuits.

Requiring Notice of the Claim

Section 3 of HB 1774 requires a policyholder to inform the insurance company of the nature of her dissatisfaction before proceeding in a lawsuit against the insurance company.

Background and Explanation

Under current Texas law, a person who is considering suing her insurance company for unfair claim-settlement practices must send a pre-suit notice (called a “demand letter”) to the insurance company at least 60 days before filing a lawsuit (Tex. Ins. Code § 541.154). The Deceptive Trade Practices Act (“DTPA”), which also may apply to an insurance case, also requires a 60-day pre-suit notice (Tex. Bus. & Com. Code § 17.505). The demand letter must advise the insurance company of the specific complaint and the amount of damages, expenses, and attorney fees the person has incurred in asserting the claim against the insurance company.

In response to receiving a demand letter from a policyholder, the insurance company is entitled to investigate the claim and make a settlement offer during the 60-day period before the lawsuit is filed (Tex. Ins. Code § 541.156 and Tex. Bus. & Com. Code § 17.505). The obligation to give a notice before filing a lawsuit and the right to respond to that notice with a settlement offer have been in the Texas Insurance Code since 1985 (§ 3 of HB 316 (1985)) and in the DTPA since 1979 (§ 5 of SB 357 (1979)).

The obvious purpose of the pre-suit notice requirement is to encourage settlements without litigation, based on the policyholder giving the insurance company a fair appraisal of the amount owed under the policy. However, because the existing statutes have no effective enforcement mechanism, the storm-chasing lawyers almost always ignore this requirement, thus thwarting the state’s legitimate public policy.

New Chapter 542A requires that a policyholder who intends to sue her insurance company must send a pre-suit notice to the insurance company at least 61 days before filing the lawsuit. The new provision is enforced by impacting the plaintiff attorney’s recovery of legal fees from the defendant. If a defendant in an action governed by new Chapter 542A pleads and proves that he was entitled to, but not given, a pre-suit notice stating the specific amount alleged to be owed by the insurer as required by Chapter 542A, the court may not award to the policyholder any attorney fees incurred after the date the defendant files the pleading with the court. This pleading by the defendant must be filed no later than the 30th day after the date the defendant files an original answer in the action.

A notice given under new Chapter 542A must state the facts giving rise to the policyholder’s complaint, the specific amount alleged to be owed to the policyholder for damage to covered property, and the amount of attorney fees incurred by the policyholder as of the date the notice is given. If the policyholder is represented by an attorney, the notice must state that a copy was sent to the policyholder by the attorney.

A pre-suit notice is not required “if giving notice is impracticable because the claimant has a reasonable basis for believing there is insufficient time to give the pre-suit notice before the limitations period will expire.” This enables an attorney whose client engages him near the end of the limitations period to file a lawsuit before limitations expire without having to give a notice before filing the lawsuit.

If a pre-suit notice is given by the policyholder and a potential defendant named in the notice files a declaratory judgment action during the 60-day pre-suit notice period, the court in which the declaratory judgment action is filed “shall dismiss” that action. This will prevent a defendant from taking advantage of the notice period to try to establish venue in a favorable forum.

If a pre-suit notice is not given or the insurance company is denied the ability to inspect the property, the company may ask the trial court to abate the case. The case is automatically abated unless the claimant contests the abatement. The abatement continues until the later of 60 days after a notice is given or 15 days after the inspection is allowed. A court may not compel participation in an alternative dispute resolution procedure (like mediation) until after the abatement period has ended.

A notice given under new Chapter 542A is admissible in evidence at trial.

Testimony on Storm Chasers’ Tactics

Ray R. Ortiz, Edward J. Batis Jr., Jonathan Law, Leslie Megin Koch – Ortiz Batis

“One topic in the bills involves pre-suit notice. This allows all parties an opportunity to resolve disputes before lawsuits are filed and fees and expenses incurred. If the claimant is actually seeking resolution of a dispute and nothing more, we fail to see how this would work to the detriment of the claimant. If resolution is not successful, the claimant maintains their right to file suit. We believe that this process would result in many disputes being resolved (particularly those involving smaller amounts in controversy) without the need to further burden the court system or require parties to incur unnecessary fees and expenses.”

Brian M. Chandler, Ronald P. Schramm, Jill D. Schein – Ramey, Chandler, Quinn & Zito

“The bills before the legislature call for pre-suit notice. This is merely an opportunity for all parties to try to resolve potential disputes before lawsuits are filed. This in no way prejudices the insureds from filing suit if their claim cannot be resolved to their satisfaction. It allows for additional communication and resolution and could result in a substantial savings of time and money for all involved.”

Joe Roseland – Mission Duncan Insurance Agency

“As in any event of this magnitude, there were some things that were missed by the adjusters, simply due to the tremendous number of claims that they had to work. When these oversights were brought to our attention by the insured or their contractors, supplements were made to the claim and the additional amounts due the insured would be paid. But then the public adjusters, unethical contractors and trial attorneys got involved. Claims that had been closed with repairs completed without complaint, were reopened by way of a demand letter from an attorney. This went on until late 2013, with over 6,000 lawsuits being filed in Hidalgo County, and in many cases, new claims being submitted in which the first notice of a claim was submitted by an attorney, without even giving the insurance company the opportunity to address the claim.

As the 2-year deadline for filing lawsuits approached in 2014, a whole new flurry of activity broke out by public adjusters, contractors and attorneys. Public adjusters were hanging flyers door to door, standing at entrances to supermarkets, and even standing on street corners with signs soliciting claimants for “hail damage” litigation… in many cases claims were turned in on homes not even located in the path of the hailstorm. This flurry of activity in the last 4 months before the filing deadline produced over 4,000 additional lawsuits, with many of them being the first notice of loss that the insurance company received.”

Hal Hopkins – Logic Underwriters/ Standard Casualty Inc.

“What prompts the insured to file a lawsuit? Is the insured so unhappy they contact an attorney to file the lawsuit? We believe this is not the situation. The average number of days to file a lawsuit after the claim was paid is well over 390 days, over one year. Why such a long delay? We believe the insureds are prompted by the attorney to file the lawsuit. Billboards are placed in strategic areas hit significantly by hail. Flyers and handouts are also utilized to induce the insureds to file demands and lawsuits for the promise of receiving additional monies.

And the lawsuits that are filed are “cookie cutter” in format. Many of the suits contain the same generalized allegations and very few, if any, claim specifics. In fact some of the lawsuits are served to a past president of Standard Casualty’s who has been deceased now for over three years.”

James Dickey – iMGA, Independent Insurance Agent

“We’ve also seen more extreme examples. Ones where they claimed that:

• We were somehow involved in handling the claim, when we never are,

• There was damage to a garage even when there wasn’t a garage,

• The adjuster had done a terrible job when a claim had never even been reported, so there was no adjuster.”

Discouraging Excessive Demands Attorney Fees – The 80/20 Rule

Because excessive demands are an essential component in the abusive litigation model employed by storm-chasing lawyers and thwart Texas’ longstanding policy favoring early settlement of disputes, Section 3 of HB 1774 incentivizes plaintiff attorneys to make realistic demands for damages by limiting the amount of attorney fees they may be awarded when the initial demand is excessive.

Background and Explanation

The litigation model used by storm-chasing attorneys includes persistent over-claiming on behalf of their clients. These attorneys always assert that if the insurance company had adequately investigated the claim, it would have found and paid for additional property damage. (As an aside, this argument is legally unfounded. The law is clear that a policyholder has a duty to point out covered losses, not that the insurance company has an obligation to find damage to property it does not control.) Then the paid “experts” working for these lawyers will assign astronomical values to the multitude of previously undiscovered items of damaged property, thus creating a demand for payment that no reasonable person would ever pay.

Storm-chasing lawyers take these excessive demands into mediation and use them to negotiate for the highest settlement amount they can extort from the insurance company—often on behalf of multiple policyholders in a single mediation session. Then they reimburse themselves for their expenses, take their cut in fees and give the policyholder whatever amount is left over. When this scheme is employed over and over for thousands of policyholders, the lawyers get rich.

Texas courts already recognize a doctrine that prevents a lawyer from forcing an opponent to pay his attorney fees when the lawyer makes a demand on his client’s behalf that is excessive and prevents resolution of the dispute. The “excessive demand doctrine” is an all-or-nothing doctrine. Either the attorney is barred from recovering fees from the litigation opponent or not; there’s no middle ground. However, some Texas trial courts simply refuse to acknowledge the doctrine. In other words, while the doctrine is good policy, in practice it has not worked to stop mass-tort abusive litigation models, such as the one used by storm-chasing lawyers.

New Chapter 542A basically implements a form of the excessive demand doctrine to solve the problem of over-claiming, but it is not “all or nothing.” HB 1774 provides that the attorney fees that may be awarded in an action governed by the new Chapter may be limited, as follows:

- If the policyholder is to be awarded in a judgment 80 percent or more of the amount demanded in the required notice, her attorney fees are not limited by the new Chapter. In other words, the insurance defendant will pay all of the plaintiff’s attorney’s reasonable and necessary fees, as found by the trier of fact.

- If the policyholder is to be awarded in a judgment less than 20 percent of the amount demanded in the required notice, then the insurance defendant is not required to pay the plaintiff’s attorney fees.

- If the policyholder is to be awarded in a judgment 20 percent or more, but less than 80 percent, of the amount demanded in the required notice, the amount of reasonable and necessary attorney fees determined by the trier of fact is proportionally reduced in the judgment. In other words, if the policyholder will be awarded in the judgment 50 percent of the amount demanded in the notice, the insurance defendant must pay 50 percent of the plaintiff attorney’s reasonable and necessary fees found by the trier of fact.

Storm Chasers’ Tactics in Action

Casey Armstrong – Brown Sims

“In 2015, Brown Sims successfully defended a small farm mutual insurance company who became the target of a first party bad faith and DTPA lawsuit typical of the types of claims plaguing the state of Texas. The initial demand received from the claimant’s counsel was over half a million dollars on a policy providing less than $100,000 in property coverage. The unanimous Harris County, Texas jury found no breach of contract, no violation of the Texas Insurance Code, no insurance bad faith, and no violation of the Texas Deceptive Trade Practices Act. This should not be the typical claims presentment process. Fighting this continued practice of abusive litigation is not sustainable, and legislative intervention to protect the citizens of Texas is required.”

James Dickey – iMGA, Independent Insurance Agent

“There was an obvious pattern. Usually it would look something like this: either the claim was already paid and the roof already replaced, or the insured would never have contacted us at all. Then, after at least a year of total silence – no complaints, no request for additional payment, nothing – the lawsuit would arrive, asking for an amount larger than the total cost to fix the house.

The insurance company would spend tens of thousands defending the lawsuit, then finally, the case would settle for a small fraction of the original amount demanded, with the plaintiff’s lawyer getting several times more than the insured.”

Dan K. Worthington, Sofia A. Ramon, Elizabeth S. Cantu – Atlas, Hall & Rodriguez

“As a matter of the norm, we routinely deal with (or observe) what can fairly be characterized as abusive litigation tactics arising out of a first party claim for insurance benefits alleged to have resulted from storm damage to property, without regard to the merits of the claim.

These tactics include:

The intentional use of an overstated estimate as a basis for an initial settlement demand. Once the case proceeds to litigation and ultimately, trial, the initial demand is either discarded by the claimant’s counsel entirely or the retained expert providing the estimate attempts to substantially limit the estimate and testifies that the estimate was not intended to provide evidence of damage related to a particular event, but rather represents only an opinion of the value of all damage observed on the date of the inspection, which may be consistent with a particular peril.

… It benefits both the insurer and the insured if the initial demand is more realistic and as close to the actual amount of claimed damages as can reasonably be estimated.”

Delinda R. Johnson – Packard, Hood, Johnson & Bradley

“Insurers are presented with outrageous demands made with no support or documentation for claims which were long since closed without complaint. Many times, suit is filed without a demand letter at all or at the same time the demand letter is sent. Plaintiffs’ counsel then continue to refuse to provide an estimate or detailed description of their damages until forced to do so by a court well into litigation. Instead, we receive “cookie cutter” petitions and no detail until their expert witness designation deadline expires.

Deposing the plaintiffs can be of little help. Many times they are not sure why their claim is in litigation. They have been frightened or enticed to litigate a claim rather than assisted in resolving it because certain counsel wish to generate legal fees. I have tried cases where the plaintiffs still do not understand how a deductible works at the time of trial after literally years of legal representation. I find myself feeling sympathy for these policyholders who have been dragged along for a very bad ride with their best interests disregarded.”

“In particular, I support the notice provisions and insurers’ ability to assume liability for an adjuster. The notice provision will provide insurers with an opportunity to resolve claims before litigation begins.”

Stopping Abusive Lawsuits Against Individuals

Section 3 of HB 1774 allows an insurance company to irrevocably assume all liability that may arise from the acts of its agents in the claim-settlement process, thus guaranteeing that the policyholder’s damages will be paid in full and freeing adjusters and other agents to do their jobs.

Background and Explanation

From mid-2012 through the end of February 2017, storm-chasing lawyers have filed over 36,000 lawsuits against property and casualty insurance companies, mostly related to hail and wind claims. In almost 14,000 of those lawsuits, the storm-chasing lawyers have named an individual (typically a claims adjuster) as a co-defendant with the insurance company.

This level of litigation against insurance claims adjusters is unprecedented. Texas is the lawsuit capital of the world when it comes to lawsuits against insurance claims adjusters. Unless the needless and harassing naming of adjusters as defendants is stopped, there is a genuine concern that out-of-state adjusters will simply refuse to work in Texas when the next mass event (like a hurricane) hits our state.

To address this problem, new Chapter 542A provides that an insurance company may assume the liability of any agent (defined to mean “an employee, agent, representative, or adjuster who performs any act on behalf of the insurer”) who is or may be sued by the policyholder. If the insurance company assumes an agent’s liability, that agent may not be sued. If the agent is sued, the lawsuit against the agent must be dismissed.

In regard to any agent whose liability is assumed by the insurance company, the insurance company must make the agent available at a reasonable time and place to give deposition testimony, unless making the agent available has become impracticable because of changed circumstances, or the agent would not have been a proper party in the first place, or obtaining the agent’s deposition testimony is not warranted under the law. If the insurance company does not make the agent available to give deposition testimony, the insurance company suffers a serious consequence – it loses the right to have the policyholder’s attorney fees limited for making an excessive demand.

If an insurer elects to assume an agent’s liability, the case is nonetheless tried as if the agent was a party to the case. Evidence of the agent’s acts or omissions may be offered at trial and a jury may be asked to determine the agent’s responsibility for claim-related damage caused to the claimant. The insurance company must pay to the plaintiff any damages attributed to its agent’s conduct, as determined by the jury.

An insurance company may not revoke its election to assume an agent’s liability, and a court may not nullify it. The company’s election is ineffective to obtain an agent’s dismissal if it is conditioned in a way that would allow the company to escape the obligation to pay any part of the agent’s liability.

An insurance company that is in receivership may not accept an agent’s liability.

Storm Chasers’ Impact on Real People: Testimony by Victims of Needless Lawsuits

Luz Monarrez – Insurance Company Employee

“I have been personally sued on multiple occasions. It was something I never expected to occur… I was sued in multiple cases for processing and paying replacement cost benefits for our policyholders that sustained damage in the hail storms that occurred in 2012 in McAllen, Texas. I did not inspect these homes or write an initial estimate to repair homes; I merely processed and paid replacement cost benefits on these claims.”

“…The stress of having my name on a lawsuit is something I have no words for. Reading the lawsuit made me feel sick to my stomach as the attorney suing me claimed I had done terrible, horrible things, including not spending enough time inspecting the home – again, I was not even the adjuster who inspected.”

Felipe Farias – Adjuster

“Since 2014 I have been sued over 12 times. This is more than all of the lawsuits I have ever received in my 24-year career. The majority of these claims are weather related claims. I have not changed the way I handle claims, the way I inspect them, the way I treat my customers. I follow the policy guidelines and treat everybody fairly.”

When asked about a suit he is currently in…

“I inspected the roof, paid for the roof, the homeowner turned in a receipt for the replacement of the roof. I did not pay for the replacement benefits, someone like Luz did, and never heard anything from the homeowner. A year later [the homeowner] filed a lawsuit saying I did a bad inspection. My cohort like Luz that sat in our claims central operation was also named a part of

the suit because she issued the check based on my estimate. So I was never made aware it was an issue, had any problems. I got a demand letter asking that there was additional damages. At that point, I tried to contact the attorney to re-inspect for additional damages. I received a lawsuit paper. So he didn’t even give me the opportunity to do my job, to re-inspect, and look for additional damages a year later.”

Ken Phillips – Ideal Adjusting

“…Since that time, we were served with over 600 lawsuits with all but one being in Texas. We handle over 11 states, yet over 99 percent of the litigation occurs in Texas…”

“…We see clear trends that our staff of adjusters prefer not to come to Texas to handle claims because of the fear of lawsuits. In fact, many of our in-state Texas adjusters are turning to out of state catastrophe work rather than handle claims here in Texas. This makes it extremely hard to gear up to properly handle large storms in Texas.”

“…This makes it much more difficult to conduct business here in Texas than our other states that we service.”

Michael Wardlaw – Wardlaw Claims Service

“We have been in the insurance claims adjusting business since 1965. Prior to 2002 (the first 37 years) neither Wardlaw Claims Service nor any of its adjusters were named in any lawsuits involving insurance claims. Since 2002 (the last 15 years) Wardlaw Claims Service and/or its adjusters have been named in over 1,000 lawsuits. We have never received a judgement against Wardlaw or its adjusters.”

Tim Molony – Nomad Adjusting

“In 2017, Nomad Adjusting will likely be served with our 430th lawsuit since Hurricane Ike. To put this in perspective, we are licensed to conduct business and handle claims in 22 states. Our business volume is a fairly even 50/50 split, with half of our business in Texas and the other half outside of Texas. However, over 99% of litigated claims that we’re involved in are in Texas. We have only been served in 3 lawsuits outside of Texas, and of those 3, we weren’t named as a party in any of the lawsuits.

In Texas, we once received 77 lawsuits in a single day from a single law firm. However, I have never been deposed as corporate representative for a lawsuit filed in Texas, and we have not had one judgment against us to date.”

“The lawsuits we have been served with are all boilerplate, and the facts aren’t relevant. Due diligence isn’t conducted to find out if there is a factual basis to sue. In fact, we’ve been admonished in mediations and told that ‘we’re not here to deal with facts. Carriers and adjusters live in the world of facts, but we (plaintiff attorneys) live in the world of the jury. You can have your facts.’

We’re named in lawsuits where we had no involvement in the handling of the loss. Our adjusters are spending time executing affidavits on claims that we didn’t adjust. I’m dumbfounded that this is acceptable for anyone. I shake my head every time I’m reminded of the very low bar held for these lawsuits.

Because this is a numbers game, the offenders on the plaintiff attorney side don’t want any path to reasonably settle a claim that doesn’t involve them and their attorney fees. These law firms avoid communication that would timely resolve disputes based on facts. In other states, if something is missed, policyholders call the carrier or us and advise of any oversight. This doesn’t happen in lawsuits in Texas. The common trend is that no notice of any dispute is made ahead of the suit being filed.”

My name is Johnny Michalek and I’m proud to be a third-generation independent insurance adjuster here in Texas and a past Executive Committee member of the Texas Independent Insurance Adjusters Association, a past president of the National Association of Independent Insurance Adjusters, and a past president of the International Institute of Loss Adjusters. My grandparents, Mike and Betty Michalek, started our firm, Gulf Coast Claims Service of Houston, in 1963. My dad, Jim, joined the family business in 1966, and I joined in 1982. My son made it a four-generation family business when he joined in 2007. We’re very proud of our family business and proud to be small business owners in Texas, employing 32 Texans.

Over the next couple of minutes, I’m going to tell you about the hardship that our firm, our staff and our family have gone through over the last 10 years due to the explosion of hail related litigation in Texas. This has been a nightmare for us and caused us so much hardship both economically and emotionally.

First, let me say that our firm has never had a judgement against us. After being sued so many times on hail claims, we’ve never been asked to contribute to any settlement.

Economically, we’ve suffered in the following ways:

- Our professional liability insurer requires that we report every lawsuit or situation that may give rise to a lawsuit. Over the past 10 years, we had to notify our E&O insurer over 300 times, the vast majority of those being lawsuits against us. As a result, we are rated at a higher premium just because we work in Texas. Each and every year, our E&O premiums increase.

- We have had to turn down otherwise-lucrative business from insurance companies to handle their claims because those insurers would not provide a defense for our firm or adjuster in the event we were sued. As a small business, we simply cannot risk potential defense costs up to our E&O deductible of $10,000 on each and every potential lawsuit. It could put us out of business overnight.

- The hail litigation has forced us to change our business model, as we can no longer afford to help insurers and Texas policyholders by handling claims on a fixed fee schedule. The target of “reasonable investigation” under Chapter 541 of the Texas Insurance Code keeps moving as a result of the hail litigation, and we are now spending three to four times the amount of time at a property than just two to three years ago.

- The hail litigation has taxed our field and office resources in that, in many cases, we cannot bill our insurance company clients the time we spend assisting in the defense of the lawsuit. Things such as answering discovery and production requests, meetings with defense counsel, and time spent in depositions and mediations. As a firm, we have to pay our employees for that time but we do not always get to bill our insurance company clients for it.

Here are just a few examples of the emotional hardships:

- Our firm has been sued on claims that our firm has never even handled.

- Our firm has been asked to handle claims when the first notice of a loss is the lawsuit itself.

- Our firm and our adjusters are routinely accused in the petitions of violating just about every rule under chapters 541 and 542 of the Texas Insurance Code, regardless of the circumstances. In the majority of these lawsuits, the wording has been almost identical.

- We’ve been involved in claims where a lawsuit was filed before the claim was ever turned in to the insurer, yet nasty mishandling accusations were made in the lawsuit.

- We’ve had sub-contract storm adjusters from out of state refuse to come to Texas anymore to handle claims for fear of being sued.

- We’ve had sub-contractors up for promotions in their primary occupation be questioned by their employer about being a party to lawsuits after civil background check procedures, potentially harming their ability to get raises or promotions.

- We’ve had a plaintiff’s lawyer refuse to non-suit an adjuster who died after inspecting the claim, causing tremendous heartache to his widow.

- We’ve had friends in our business close their doors as they simply couldn’t deal with the lawsuits any longer.

- Lastly, my son that I mentioned earlier, our fourth-generation family member, left our business in 2013 for the sole reason that he did not want to subject himself or his family to what our business has become and the hardships that have befallen some of the finest Texans you’ll ever meet, and those are Texas independent insurance adjusters.

I appreciate you listening today.

Johnny Michalek

Adjusting the Penalty Interest Rate

Section 2 of HB 1774 adjusts the penalty interest rate assessed under the Prompt Payment of Claims Act from a fixed 18 percent to a variable rate, with a floor of 10 percent and a ceiling of 20 percent.

Background and Explanation

The Prompt Payment of Claims Act was adopted by the Texas Legislature in 1991 (§ 11.03 of HB 2 (1991)). As drafted in 1991, the Act imposed deadlines on an insurance company to:

- Acknowledge receipt of and begin to investigate a policyholder’s claim;

- Notify the policyholder of the acceptance or rejection of her claim; and

- Pay the amount of the claim that was accepted.

If an insurance company failed to comply with the statute, it was liable for an 18 percent per annum penalty and responsible for paying the policyholder’s attorney fees. The Act was designed as a strict liability statute in 1991—if the insurer failed to comply with the statute, it was liable for penalty interest and attorney fees without regard to fault.

The Act remains largely unchanged today. It still contains multiple deadlines, and it remains a strict liability statute, imposing an 18 percent per annum penalty and requiring payment of the policyholder’s attorney fees.

In 1991, when the 18 percent per annum penalty was instituted, the prime rate was much higher than it is today. In 1991, the penalty rate was about two times the prime rate. Today, the 18 percent penalty is closer to five times the prime rate. It is the highest penalty interest rate in the nation applicable to the payment of property insurance claims.

In addition to paying an 18 percent per annum penalty, an insurance company that is sued for paying a claim late must pay pre-judgment interest on the amount owed to the policyholder. Under Texas law, pre-judgment interest is based on the prime rate, with a floor of 5 percent and a ceiling of 15 percent. As a consequence, an insurance company that is sued for failing to timely pay a claim currently will pay interest totaling 23 percent (18 penalty + 5 pre-judgment) to 33 percent (18 + 15) per annum; and also will be liable to pay the policyholder’s attorney fees.

To reflect fluctuations in the interest rate market, HB 1774 creates a variable penalty interest rate, with a floor of 10 percent and a ceiling of 20 percent. When coupled with pre-judgment interest, an insurer that pays a claim late will pay a total of 15 percent (10 penalty + 5 pre-judgment) to 35 percent (20 + 15) on the underpaid funds due the policyholder and pay the policyholder’s attorney fees. The combination of strict liability, a combined interest rate of 15 to 35 percent, and responsibility for policyholder attorney fees continues the current law’s strong incentives for insurance companies to pay claims promptly.

How Penalty Interest is Abused in the Storm Chasers’ Model

Buddy Steves, Myron F. Steves Co., CMGA

“The driver for the litigation is legal fees and penalty interest, not actual damages.

In Ike, 525 days elapsed on average from the initial report of the claim by a property owner and filing of a letter of representation of a lawsuit. Insureds unhappy with their initial settlements would not take 18 months or more to contact an attorney.

Despite notice to all policyholders of their right to report complaints to the Department of Insurance, virtually no complaints are filed by property owners who are represented by attorneys in the 525 days between the initial report and the attorney representation.

In litigation, only rarely do the plaintiff attorneys focus on the actual damages. The negotiations focus on the leverage that the attorneys hold over the insurers regarding the attorney fees that will be awarded and the penalty interest that will be recovered if they prove up even a modicum of additional damages during a trial.”

Dan K. Worthington, Sofia A. Ramon, Elizabeth S. Cantu – Atlas, Hall & Rodriguez

“… given the array of exemplary and punitive awards, the statutory interest currently in place is far too high and, in our opinion, serves as a penalty where there is no evidence of intentional or reckless behavior. The proposed revision to the PPOC (prompt payment of claims) statutory interest also appears to be a far fairer solution when balanced with the needs of the insured to be timely paid or otherwise compensated for a covered loss.”

Mark A. Lindow – Lindow, Stephens, Treat

“Changing the rate will still accomplish what the drafters intended – encourage insurers to handle and pay claims timely. It will, however, lessen some of the negative incentives that encourage plaintiffs’ counsel to round up lots of clients and then delay the process to enhance their own pocketbooks.”

Insurance Float, Penalty Interest and Standards of Reasonability

The Texas Prompt Payment of Claims Act currently imposes an 18 percent penalty interest on an insurer that is found to have underpaid a claim. The penalty is imposed on a no-fault basis – that is, the penalty is imposed even if the insurer acted in good faith and without negligence. Texas’ 18 percent penalty is the highest in the nation. Only four other states impose penalty interest on insurers – three of those states impose a 12 percent penalty and the other, a 10 percent penalty.

HB 1774 changes the current fixed 18 percent penalty to a market-based floating rate tied to the prime rate, with a floor of 10 percent and a ceiling of 20 percent.

In considering this provision of HB 1774, please consider these points made in a paper entitled Insurance Float, Penalty Interest and Standards of Reasonability by Robert P. Hartwig, PhD, CPCU, University of South Carolina:

- Profitability in the insurance industry depends on a steady stream of incoming revenue (i.e. satisfied customers who continue to pay premiums for their insurance coverage), which in turn depends on the company regularly paying claims timely and fairly.

- Because it is expensive for insurers to acquire new customers, the cost of losing a customer to poor claims handling exceeds the potential return an insurer could make on investing the float.

- Investment opportunities for shorter-tailed lines, such as property and auto insurance, are not as lucrative as those for longer-tailed lines, such as worker’s compensation, asbestos or malpractice. That is because of the shorter time between an insurance claim and payment, unlike a long-tailed claim where the injured party receives payment over several years or where there may be an extraordinarily long span between the time when premiums are paid and the time when a claim is paid.

- When a claim against a property insurer occurs, insurers establish a reserve to pay the expected future costs of the claim. The funds are invested at the prevailing rate of return available for new investments, known as the “new money yield.” That yield in 2015, the last year for which data was available, was 1.7 percent.

- Texas’ 18 percent penalty is more than 10 times the new money yield available to insurers.

- Texas’ 18 percent penalty is triple the 6 percent rate charged by the IRS to even the largest corporations that are delinquent in their taxes.

- The combination of very low rates earned on insurance reserves to pay short-tail claims and the cost of replacing customers when they leave because of poor claim handling incents insurers to pay claims on time.

Click here to read the Bill text: House Bill 1774

TLR’s Response to TTLA’s Attacks on HB 1774

TTLA IS “ADAMANTLY OPPOSED” TO HB 1774

Despite the significant changes that have been made to HB 1774 to address concerns raised by the Texas Trial Lawyers Association (“TTLA”) and other trial lawyers over multiple stakeholder sessions, TTLA “remains adamantly opposed” to the bill. Why?

THE TRUTH: A growing number of trial lawyers – some of them members of TTLA – have filed over 36,000 weather-related lawsuits since mid-2012. They’ve filed 13,000 since the end of last session alone. If these lawyers make $10,000 per lawsuit as their fee when they settle a case (which is a conservative estimate based on TDI’s data), they stand to make a staggering $360 million in legal fees on the lawsuits they have already filed, and $130 million on the lawsuits they filed after the Legislature adjourned in 2015.

In the cases that actually go to trial, the storm-chasing lawyers often seek to recover $150,000 or more in legal fees from the insurance company. Plainly, these lawyers’ model is built around recovery of high sums in attorney fees, either through bulk settlement of multiple cases or at trial in an individual case.

TTLA ASSERTS THAT HB 1774 WILL “FORCE” CASES TO FEDERAL COURT

HB 1774 provides that an insurance company may elect to assume the liability of any agent, employee or adjuster who the policyholder believes is legally responsible for any part of her damages in a property claim-related dispute. TTLA asserts, in a combination of hyperbole and falsehood, that this provision allows insurance companies to “use federal law to force most homeowner cases and virtually all business disputes into backlogged federal courts, where it takes twice as long to receive justice.”

THE TRUTH: The storm-chasing lawyers dislike federal court, not because federal courts are slow, but because Texas federal judges have shown they will not stand for the lawsuit abuse these lawyers are perpetrating. Three recent federal court orders by Texas federal judges (included in this binder) show why the storm chasers want to avoid federal court. These courts quickly resolved the cases and chastised the plaintiff lawyers for their meritless lawsuits.

TTLA has never presented any evidence that it takes “twice as long” to resolve insurance cases in Texas federal courts than in Texas state courts. The truth is that federal courts keep statistics differently than do state courts, therefore it is impossible to make an apples-to-apples comparison based on the official data.

Additionally, if state courts are unhampered by the kind of backlogs that supposedly affect federal courts, why is Hidalgo County asking the Legislature to create new courts? See SB 1329 and SB 1593 (creating a new county court at law in Hidalgo County); and HB 3235 (creating a new district court in Hidalgo County). Hidalgo County has been overwhelmed with hail/wind lawsuits since 2012.

Furthermore, the right to move a lawsuit from state to federal court is granted by the U.S. Constitution—not by HB 1774. Article III, Section 2, of the U.S. Constitution provides that an out-of-state defendant has a right to be sued in the local federal court located in the state where the plaintiff lives. When this constitutional provision is invoked to move a case from state court to the local federal court, Texas law still applies, a Texas judge presides over the case, and a jury comprised of Texans decides the dispute.

In fact, it is the storm-chasing lawyers who are forum shopping by purposely suing innocent Texans as co-defendants in their lawsuits against insurers. Further, those lawyers are manipulating their pleadings to keep their lawsuits in a court of their choice. In order for a case to be moved to federal court by an out of state defendant, the amount in controversy in the case must be more than $75,000. A typical, legitimate homeowner case arising from a hail storm should not have anywhere near $75,000 in controversy. But in order to enhance their negotiating position to recover legal fees, storm-chasing lawyers exaggerate the damages to exceed $75,000, which makes the case susceptible to being moved to federal court by an out-of-state defendant. If the storm-chasing lawyers would plead for an amount of damages that is factual, rather than conjure damages from thin air, their cases could not be moved to federal court.

Finally, it is our state’s farm mutual insurance companies that are most seriously at risk of losing their capital and ability to write insurance because of this lawsuit abuse. When they are sued, they have no right under the U.S. Constitution to remove the case to federal court, no ability to sell stock to raise capital, and the cost of needless litigation is borne by their own policyholders, who are owners of the companies.

TTLA ASSERTS THAT HB 1774 IMMUNIZES AGENTS AND ADJUSTERS

According to TTLA, HB 1774 “immunizes agents and adjusters by allowing insurers to ‘accept’ their liability.”

THE TRUTH: HB 1774 does not grant immunity to anyone for anything. The word “immunity” does not appear in the bill anywhere.

HB 1774 provides that insurance companies may assume an agent or adjuster’s liability. By assuming that liability, the insurance company guarantees payment of any amount owed to the plaintiff by the agent. That person’s liability is: (1) determined by the jury and (2) paid by the insurance company, thus guaranteeing that the insurance company makes whole the policyholder for any harm done by the dismissed individual. TTLA’s accusation that the bill provides “immunity” implies that damages caused by the agent would be unpaid, which is patently false.

TTLA ASSERTS THAT HB 1774 PREVENTS DISCOVERY FROM AGENTS OR ADJUSTERS

According to TTLA, “individual adjusters and their employees are often the most important witnesses in an insurance lawsuit,” and HB 1774 not only provides them immunity, it fails to require their availability for discovery, deposition and/or trial.

THE TRUTH: First, HB 1774 provides that when an insurance company assumes an agent, employee or adjuster’s liability, the insurance company must make that person available to give deposition testimony. If the insurance company fails to produce the agent for a deposition, the insurance company cannot benefit from the attorney fee limitations (described below) that are tied to the claimant’s demand. It is important to note that when a witness gives deposition testimony, he can be forced to produce all relevant documents. Under the Texas Rules of Evidence, the testimony a witness gives in a deposition can be used at trial as if the witness is attending trial in person. In fact, videotaped deposition testimony is used in virtually every case tried in a Texas court.

Second, the statement that the adjuster or employee is the “most important witness” should not be taken at face value. If the plaintiff’s lawsuit is based on an alleged failure to properly investigate the claim (and that always is the primary allegation), it is the policyholder’s testimony that is critical. He or she will testify that the adjuster did not spend enough time conducting the investigation. The adjuster can be expected to contravene that testimony, not support it. Having the adjuster’s testimony is far more likely to be harmful than helpful to the policyholder, which is one of many reasons why an adjuster’s deposition is rarely taken in lawsuits pursued by the storm chasers.

Third, many lawsuits of all kinds involve witnesses who are not defendants. The Rules of Civil Procedure allow a plaintiff to obtain documents and testimony from non-parties and it happens literally every day in Texas.

TTLA ASSERTS THAT HB 1774 INCREASES THE BURDEN ON POLICYHOLDERS

HB 1774, according to TTLA, “shifts the burden to policyholders to conduct a costly investigation and provide a duplicative pre-suit notice that includes ‘all acts or omissions’ and ‘specific damages.’”

THE TRUTH: For more than 30 years, plaintiffs suing insurance companies under the Insurance Code or Deceptive Trade Practices Act have been required to provide a notice detailing the policyholder’s complaint, at least 60 days prior to filing a lawsuit. These existing statutes require that the plaintiff state the amount owed by the insurance company on the claim and the amount of attorney fees that were incurred by the plaintiff’s attorney to investigate the claim and write the “demand letter.” The problem with these existing notice requirements is that they are not self-enforcing and, therefore, are routinely ignored by the storm-chasing lawyers.

HB 1774 simply gives force to the requirements that exist in current law by providing that an attorney who refuses to give notice before filing a lawsuit may lose his ability to recover attorney fees from the defendant. The bill does not create a new or burdensome requirement, it adds teeth to existing requirements.

Additionally, Texas law always has been clear that the insured has the burden to establish a covered cause of loss during the applicable policy period. Insurance policies and Texas law require the insured to contact the insurer and identify and quantify the damage he or she claims is payable under the insurance policy. Under Texas law, the insurer has no burden to actively seek information regarding additional damage when the insured has made no report of such damage. This is plain common sense. The property owner knows when he has suffered damage and must report it to the insurance carrier for the carrier to meet its obligations.

Furthermore, every attorney in Texas has a duty to investigate his client’s claim before filing a lawsuit. In fact, when a Texas lawyer signs a pleading, he is attesting to the validity of the claims being asserted. HB 1774 does not impose a costly burden on policyholders or their attorneys. It recognizes longstanding Texas law.

Finally, HB 1774 specifically provides that all pre-suit notices required by law may be combined into a single document, which means that nothing “duplicative” is required.

TTLA ASSERTS THAT HB 1774 REQUIRES A “FALSE CALCULATION” OF ATTORNEY FEES

According to TTLA, HB 1774 requires a “false calculation” of attorney fees by the policyholder “before [the policyholder] has had the ability to discover the full extent of the insurance company’s wrongdoing.”

THE TRUTH: First, as noted above, for more than 30 years, Texas law has required that a plaintiff in a dispute with an insurance company send a pre-suit demand letter stating the amount of attorney fees the plaintiff has incurred to that point in time. If providing a statement about the attorney fees incurred as of the time the notice is given is a problem, it has been a “problem” for more than three decades.

Second, the shortest statute of limitations applicable to a property claim case is two years. The pre-suit notice must be given at least 60 days before the lawsuit is filed. This means the plaintiff has up to 670 days (two years minus sixty days) to evaluate the claim before sending a demand letter. That is plenty of time to determine whether an insurance company has underpaid a claim or has engaged in wrongdoing.

Third, there is nothing “false” about calculating attorney fees based on the amount of time actually worked by the lawyer, multiplied by a reasonable hourly rate, as is required by HB 1774. Charging attorney fees by the “billable hour” is a standard in the legal profession, and is endorsed by the Texas Supreme Court as the most common way to prove attorney fees in litigation. Recording billable hours is so common in the legal profession that it can be done using an app on a smart phone.

Fourth, if one of these cases goes to trial, the storm-chasing lawyers often ask for fees based on the amount of work they put into the case, which typically means the number of hours worked (or at least an estimate of the number of hours worked).

The real complaint these lawyers are making is that having to make a pre-suit demand for attorney fees based on the number of hours actually worked disrupts their mass-tort business model.

- For a $10,000 claim, they want to demand about $17,000, so they can deduct 40% and their client still recovers $10,000. ($17,000 x .4 = $6,800. $17,000 – $6,800 = $10,200 to the client.)

- If, however, the lawyer has invested five hours investigating the claim and writing a demand letter at $400 per hour, that is only $2,000 in legal fees truly owed at that time. They do not want to demand only $12,000 ($10,000 + $2000), because if that demand is paid and they deduct 40%, then the client receives only $7,200 ($12,000 x .4 = $4,800. $12,000 – $4,800 = $7,200), making for a justifiably unhappy client, who is being disadvantaged by her attorney.

- Ethical lawyers would charge the client only what is reasonable for the work actually performed ($2,000). But the storm chasers want 40% of the total dollars paid by the defendant, no matter how few hours they have actually worked or how negatively it impacts their clients’ recovery.

- The plaintiff’s attorney fees due in property-claim cases are payable by the insurance defendant to the prevailing plaintiff. Therefore, the law contemplates that the policyholder should recover all amounts due to her under the insurance policy, and that the policyholder’s attorney recover his reasonable and necessary fees from the defendant based on hours worked. It is contrary to common sense and good public policy that an attorney take any part of the policyholder’s recovery when the statute allows the attorney to be paid his reasonable and necessary fees from the defendant, based on hours worked.

TTLA ASSERTS THAT THE 80/20 RULE PUNISHES THEIR CLIENTS FOR “GUESSING WRONG”

In an outright misrepresentation of the plain words in HB 1774, TTLA claims that if a policyholder “guess[es] wrong at the outset or learn[s] more information through the course of the suit that changes their damages, it can harm their ability to be made whole by reducing the policyholder’s rightful recovery, threatening the policyholder’s ability to make necessary repairs and reducing or denying the recovery of attorney’s fees.”